INTRODUCTION

Small and Medium Enterprises (SMEs) are the backbone of Nigeria’s economy, playing a vital role in driving economic growth, job creation, and innovation. Accounting for over 80% of employment and nearly 50% of the nation’s GDP, these businesses are key to the country’s socio-economic development (SMEDAN, 2021). Despite their critical contributions, SMEs have long been hindered by an onerous tax regime characterized by excessive burdens, administrative inefficiencies, and a lack of structural support.

Nigeria’s tax system has historically been fragmented and complex, with SMEs facing challenges such as multiple taxes levied by federal, state, and local governments, high compliance costs, and slow processes for tax refunds. These obstacles not only drain resources but also discourage many businesses from formalizing their operations, further limiting their growth potential (Oyedele, 2024). As a result, SMEs often struggle to compete, expand, and fulfill their economic promise.

Recognizing these challenges, the new tax reform bill represents a transformative step toward creating a more supportive fiscal environment for SMEs. By streamlining tax administration, reducing unnecessary levies, and introducing targeted incentives, the reform is set to alleviate financial pressures and enable SMEs to focus on growth and innovation. This pivotal intervention is not just a tax policy update—it is a strategic effort to unlock the potential of millions of small businesses across Nigeria, empowering them to drive sustainable development and economic prosperity.

CHALLENGES FACED BY SMEs IN THE CURRENT TAX SYSTEM

The existing tax system in Nigeria has long been a significant barrier to the growth and sustainability of Small and Medium Enterprises (SMEs). While these businesses contribute immensely to the economy, the tax regime imposes burdens that disproportionately affect their operations and profitability.

SMEs face a labyrinth of taxes imposed by federal, state, and local governments. From corporate income tax and value-added tax (VAT) to multiple local levies such as market taxes, business premises fees, and tenement rates, the sheer number of obligations is overwhelming. This fragmentation often results in overlapping demands and double taxation, leaving SMEs with less capital to reinvest in their operations (Presidential Fiscal Policy and Tax Reforms Committee, 2024). Also, previous tax regimes set exemption thresholds too low, disqualifying many SMEs from reliefs designed to protect smaller businesses. For example, the turnover threshold for exemption from company income tax was capped at ₦25 million—too narrow to accommodate businesses operating on modest margins but still above the microenterprise level (Oyedele, 2024). This lack of inclusivity restricted access to the tax benefits essential for SME growth and sustainability.

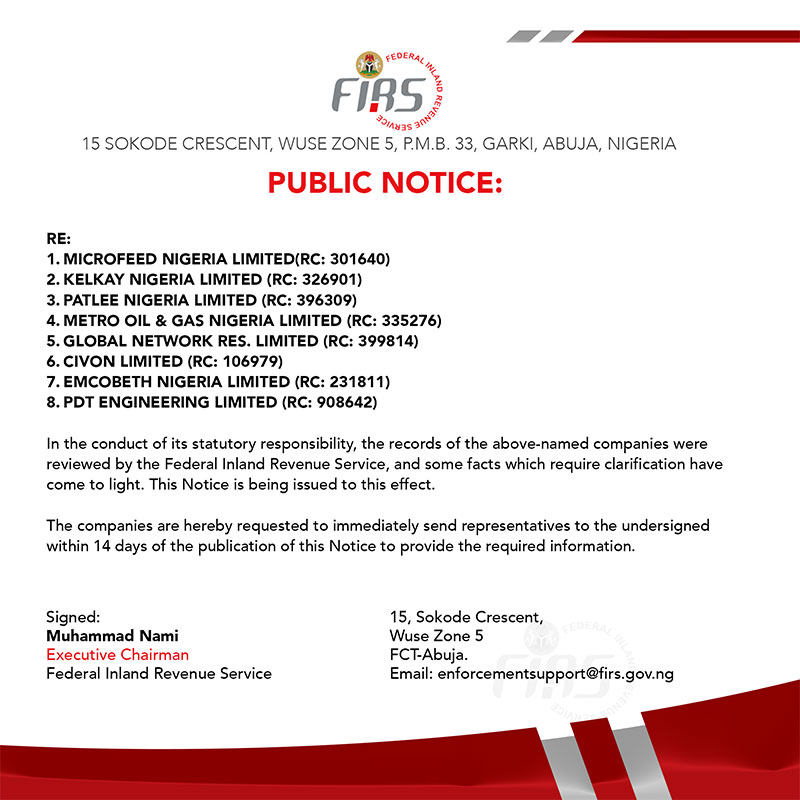

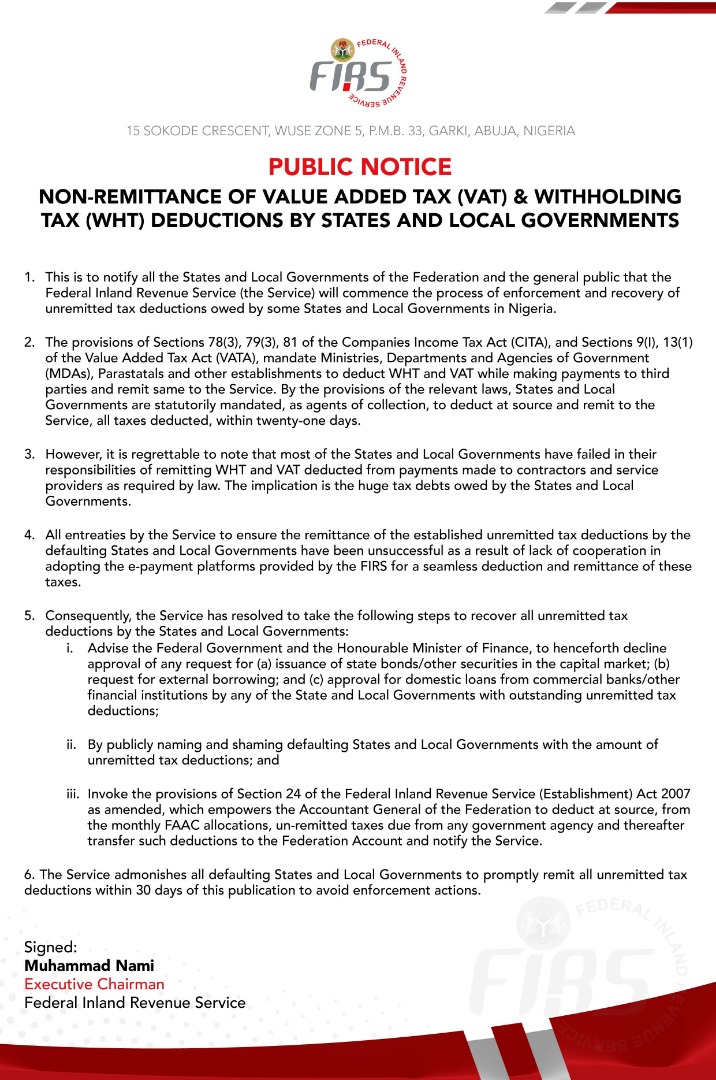

The administration of VAT poses another significant challenge. SMEs often struggle with the complexity of charging, remitting, and reconciling VAT. For businesses eligible for refunds, delays in processing create liquidity problems, further straining cash flows. These inefficiencies discourage compliance and increase the likelihood of financial penalties, pushing many SMEs into informal operations (Presidential Fiscal Policy and Tax Reforms Committee, 2024). Again, navigating Nigeria’s tax system demands considerable time, resources, and expertise. For SMEs with limited staff and financial capacity, compliance costs—including bookkeeping, audits, and engagement with multiple tax agencies—represent a disproportionate expense. This administrative burden not only diverts resources from core business activities but also discourages smaller enterprises from formalizing their operations (Oyedele, 2024).

KEY PROVISIONS IN THE NEW TAX REFORM BILL

The new tax reform bill introduces a comprehensive set of provisions designed to address the longstanding challenges faced by Small and Medium Enterprises (SMEs). These measures are not only aimed at reducing financial and administrative burdens but also at fostering an environment that supports growth, innovation, and competitiveness.

1. Elimination of Nuisance Taxes

One of the most significant aspects of the reform is the elimination of nuisance taxes—low-yield levies that disproportionately affect SMEs. These taxes, despite their minimal contribution to government revenue, impose high compliance costs on businesses. Their removal reduces unnecessary financial strain and creates a more streamlined tax landscape for SMEs. For instance, examples include the Market and Kiosk Permit Fees, which often vary across local governments, and the Signage and Advertisement Levies, which require businesses to pay for displaying their own branding. Another common example is the Right of Occupancy Fee on Rural Lands, which small businesses often find excessive relative to their scale of operations.

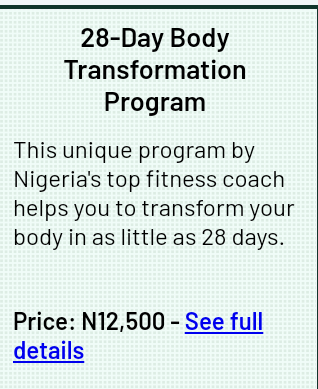

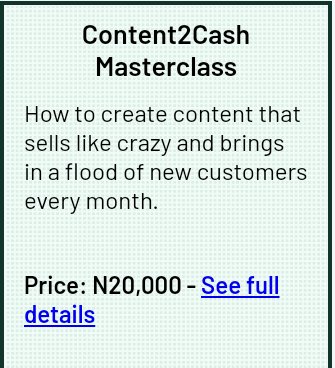

2. Increased Exemption Thresholds

The reform raises the small business exemption threshold from ₦25 million to ₦50 million in annual turnover. This change significantly expands the number of SMEs exempted from company income tax, allowing smaller businesses to operate tax-free. Take, for example, a catering business generating ₦40 million annually. Previously, this business would have been required to pay company income tax, leaving less capital for investment in equipment or workforce expansion. With the new threshold, this business is now exempt from tax, allowing it to retain more of its earnings. The owner can reinvest these savings to purchase modern kitchen equipment, enabling the business to take on larger contracts and improve service delivery. By freeing up resources that would have been spent on taxes, this provision encourages reinvestment in business operations and expansion.

3. Simplified VAT Regulations

The Value Added Tax (VAT) system has been overhauled to benefit SMEs. Over 97% of SMEs are now exempt from charging VAT, which not only simplifies compliance but also reduces costs associated with tax administration. Furthermore, businesses can claim input VAT credits on assets and services, lowering production costs and enhancing profitability.

4. Harmonization of Taxes

To address the issue of tax fragmentation, the reform consolidates multiple taxes and levies into a single-digit framework. This harmonization simplifies compliance by reducing the number of tax payments and interactions required with various tax authorities. For SMEs, it means fewer disruptions and greater predictability in their financial planning.

5. Introduction of Technological Innovations

The reform incorporates technology to improve tax administration. Electronic invoicing and fiscalization systems enable real-time filing and reconciliation of VAT, reducing errors and delays. These innovations simplify processes, improve transparency, and build trust between SMEs and tax authorities.

6. Faster VAT Refunds

Delays in VAT refunds have historically created cash flow issues for SMEs. Under the new reform, VAT refunds will be processed faster and without the need for extensive audits, ensuring that SMEs have quicker access to their funds. This improvement enhances liquidity and enables businesses to meet operational and growth needs more effectively.

7. Targeted Tax Incentives

The reform introduces targeted tax incentives, such as reliefs for research and development (R&D) and support for high-impact sectors. SMEs in priority industries can now benefit from these incentives, which promote innovation and encourage investments in strategic areas of the economy.

8. Simplified Compliance Framework

The reform streamlines compliance requirements for SMEs by reducing bureaucratic hurdles. Simplified filing processes and clear guidelines reduce the need for costly external consultants, allowing SMEs to focus on their core business activities.

9. Transparent Revenue Sharing

The reform also introduces a more equitable model for sharing VAT revenue among federal, state, and local governments. This ensures that states with thriving SME ecosystems receive adequate resources to invest in infrastructure and services that benefit local businesses. By addressing these core issues, the new tax reform bill lays the foundation for a more inclusive and SME-friendly tax system. These provisions not only reduce operational challenges but also position SMEs as vital contributors to Nigeria’s economic transformation.

BENEFITS FOR SMEs

The new tax reform bill promises a host of benefits for Small and Medium Enterprises (SMEs), addressing their most pressing challenges and creating opportunities for growth. These benefits are a direct result of provisions that simplify taxation, reduce costs, and streamline compliance. The elimination of nuisance taxes such as levies and permit fees and the exemption from VAT for over 97% of SMEs significantly reduce the financial burdens on small businesses. Additionally, input VAT credits on assets and services further lower production costs, enabling SMEs to channel saved funds into core operations and expansion.

Harmonizing taxes into a single-digit framework and leveraging technology for real-time filing reduces the administrative workload for SMEs. Simplified processes mean that SMEs no longer have to navigate multiple tax systems or deal with fragmented agencies, saving time and resources. Faster VAT refunds improve liquidity for SMEs, addressing a critical pain point for businesses that rely on consistent cash flow to manage day-to-day operations. With less capital tied up in delayed refunds, SMEs can meet their financial obligations and invest in growth opportunities.

The higher exemption threshold, raised from ₦25 million to ₦50 million in turnover, allows more SMEs to qualify for tax-free operations. This significant expansion in eligibility ensures that smaller businesses retain more earnings, boosting their profitability and sustainability. Lower tax and compliance costs improve SMEs’ ability to price their products and services competitively. With reduced financial pressures, businesses can invest in quality improvements, marketing, and customer service, gaining a competitive edge in both local and international markets.

Targeted incentives, such as reliefs for research and development (R&D), empower SMEs to invest in innovation. High-impact sectors dominated by SMEs, such as technology and agriculture, stand to benefit significantly from these incentives, driving industry-wide growth. Equitable revenue sharing under the new tax regime ensures states and local governments have more funds to invest in infrastructure. Improved roads, electricity, and communication systems directly benefit SMEs by reducing logistical costs and operational challenges.

By simplifying taxation and removing duplicative levies, the reform encourages informal businesses to formalize their operations. This formalization opens doors to benefits like access to credit, government support programs, and expanded markets, while also improving overall compliance rates. Transparent processes, faster refunds, and reduced bureaucracy build trust between SMEs and tax authorities. A system perceived as fair and efficient encourages voluntary compliance, fostering a healthier fiscal relationship between businesses and the government.

By addressing systemic inefficiencies and creating a supportive environment, the reforms pave the way for long-term SME growth. A sustainable tax system ensures that businesses can thrive without the constant fear of arbitrary levies or unpredictable costs. The cumulative impact of these benefits is transformative, positioning SMEs as engines of economic growth and innovation. With reduced burdens and greater support, SMEs can now focus on scaling their operations, creating jobs, and driving Nigeria’s development agenda.

CONCLUSION

The new tax reform bill is a monumental step forward in addressing the systemic challenges that have historically hindered Small and Medium Enterprises (SMEs) in Nigeria. By eliminating nuisance taxes, raising exemption thresholds, and simplifying compliance processes, the reforms directly reduce the financial and administrative burdens on SMEs. Additionally, the introduction of technological innovations, faster VAT refunds, and targeted incentives creates an enabling environment that fosters growth, innovation, and competitiveness.

Beyond immediate cost savings, the reforms also address broader ecosystem challenges, such as equitable revenue sharing and infrastructure development, ensuring that SMEs can operate in a supportive environment. These measures are not only timely but also necessary to unlock the full potential of SMEs as drivers of economic growth and employment.

As the reforms are implemented, it is crucial for the government to maintain transparency, consistency, and a commitment to sustained improvement. SMEs must also take advantage of the opportunities provided by the new tax regime to scale their operations and formalize their activities.

With these reforms, Nigeria stands at the threshold of a more inclusive and prosperous economy, where SMEs are empowered to thrive and contribute meaningfully to national development. The success of these reforms depends on collaboration between stakeholders, ensuring that the promise of a fair and efficient tax system becomes a reality for all.

REFERENCES

• SMEDAN (2021). Small and Medium Enterprises (SMEs) in Nigeria: Contributions and Challenges.

• Oyedele, T. (2024). Presidential Fiscal Policy and Tax Reforms Committee Report.

• Presidential Fiscal Policy and Tax Reforms Committee (2024). Overview of Tax Reform Bills.