Access Bank Plc has reported a significantly improved performance for the nine months ended September 30, 2019, reflecting the positive impact of its merger with former Diamond Bank Plc.

Access Bank Plc has reported a significantly improved performance for the nine months ended September 30, 2019, reflecting the positive impact of its merger with former Diamond Bank Plc.

The bank posted a growth of 44 per cent in profit after tax (PAT) to N90.7 billion in 2019, up from N62.9 billion in the corresponding period of 2018.

The breakdown of the performance showed that Access Bank Plc ended the period with net interest income of N210 billion, compared with N123 billion in 2018, while non-fee income rose from N37 billion to N56 billion. Impairment charges stood at N10.611 billion, compared with N8.353 billion in 2018.

Personal expenses went up from N41.4 billion to N54.6 billion, while other operating expenses increased from N82 billion to N121 billion in 2019. Despite the high costs recorded, Access Bank Plc posted a profit before tax of N103 billion in 2019, up from N70.2 billion in 2018, while PAT rose by 44 per cent to N90.7 billion, from N62.9 billion in 2018.

A further analysis of results showed that its merger with defunct Diamond Bank is yielding fruits as deposits soared from N2.56 trillion to N4.24 trillion, while loans and advances improved from N1.993 trillion. Total assets jumped from N4.942 trillion to N6.58 trillion.

Assessing the results, analysts at FBN Quest said: Access Bank’s PAT implies return on average equity (ROAE) of 23 per cent, much higher than management’s guidance of 20 per cent.

“Pre-provision profits grew by 60 per cent to N105.7 billion, thanks to strong double-digit growth on both revenue lines. Although funding income grew by 46 per cent, growth on the non-interest income line was even stronger at 77 per cent.

“The solid growth on this line contrasts starkly with the lacklustre performance on the line in second quarter (Q2) 2019. The strong growth on the line was underpinned by a 150 per cent growth in fee and commission income and forex trading gains which were up by around 474 per cent. Substantial recoveries of around N8.9 billion made during the quarter (vs. N1.4 billion Q3 2018) were also supportive,” they said.

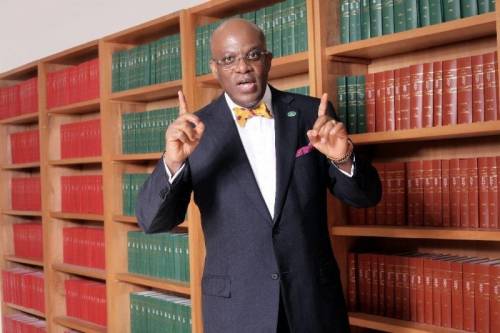

When Access Bank Plc posted similarly impressive performance in half year ended June, the Group Managing Director/CEO, Mr. Herbert Wigwe had their focus on retail market gained momentum and would be maintained going forward.

“The strong retail contribution demonstrates the effectiveness of our continued drive around low-cost deposits, on the back of an innovative digital platform. Asset quality improved as guided, to 6.4 per cent on the bank of a robust risk management approach. This is expected to trend into the future as we strive to hit and surpass the standard we had built in the industry prior to the merger. Similarly, liquidity ratio improved year on year to 49.7 per cent, reflecting deliberate steps to optimise our balance sheet in order to ensure the group’s liquidity position remains robust,” Wigwe said.

The Executive Director, Risk Management, Access Bank, Dr. Greg Jobome, had said the management and board of the bank were confident that there was value to be nurtured in the merger.

This, he said was why due diligence was done to ensure that it offer value accretion for shareholders and stakeholders.

“What we are seeing now is just the beginning because there is still so much to be reaped from that merger. If we are already showing this kind of numbers, I think there is so much to come in terms of the future and how the growth trajectory is going to go. In the short-term, we would be doing all the cleaning up that we need to do.

“We have to get the work culture, people and customer base optimised and if we are showing this kind of number, then the future is bright,” he added.